Interest Rates: Where Are They Now?

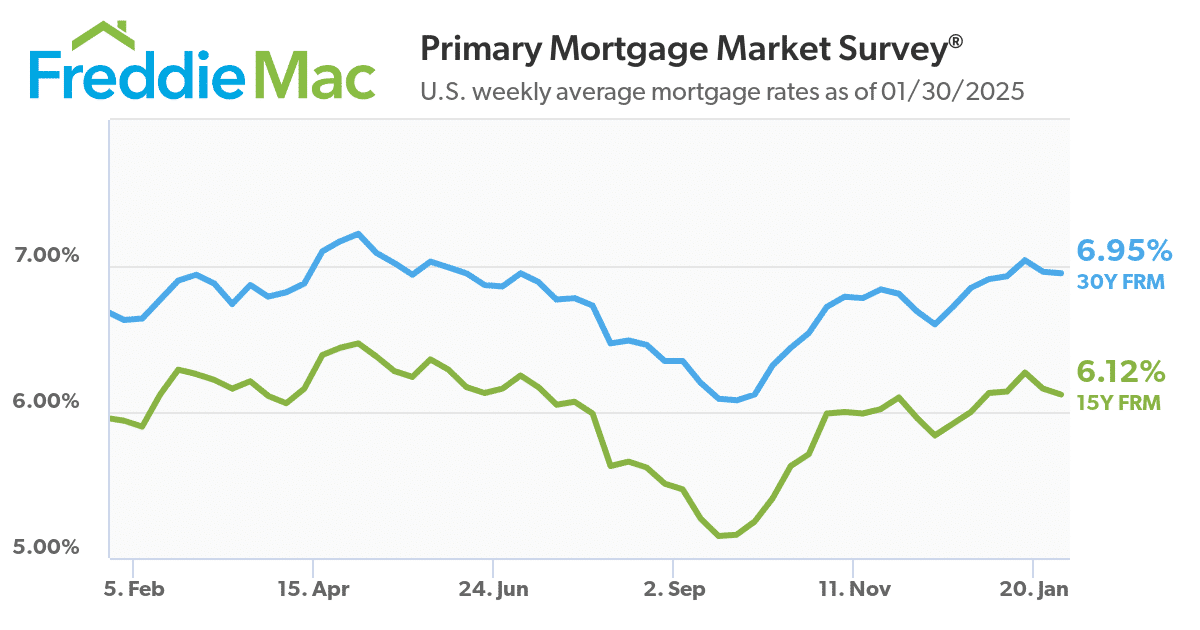

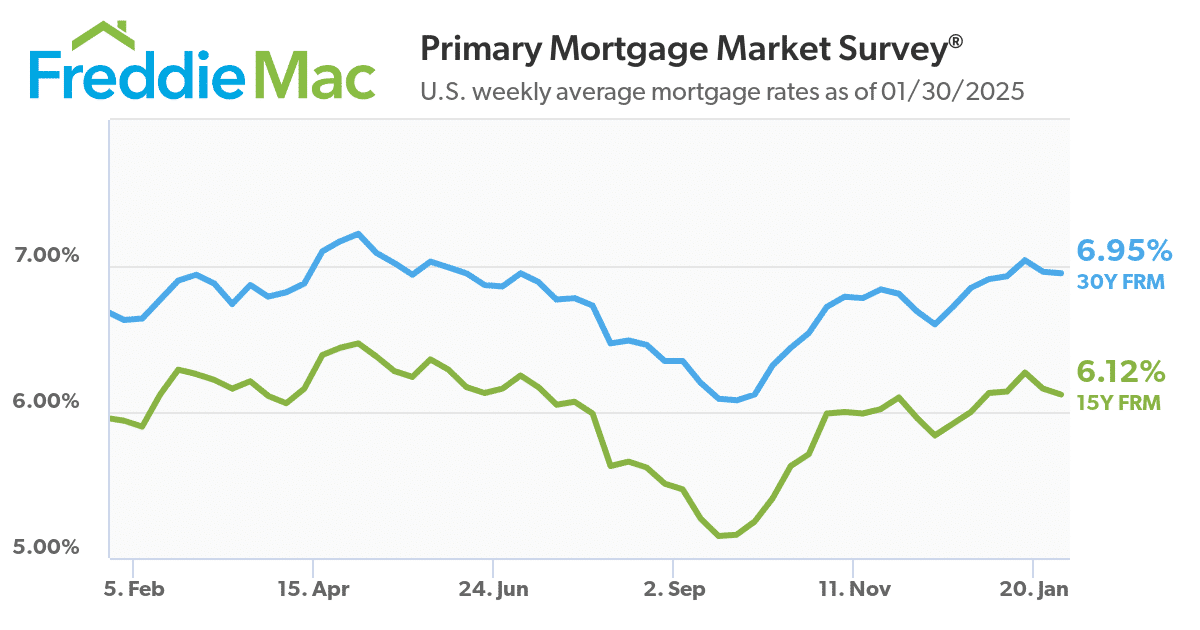

Right now, 30-year fixed mortgage rates are hovering around 6.95%, and they’ve been steadily inching up since September 2024. If you follow Freddie Mac’s weekly updates, you’ll notice this upward trend. But remember that mortgage rates can fluctuate day to day based on various economic factors, particularly inflation.

A Quick Note on the Fed’s Role

The Federal Reserve (the “Fed”) does not directly set 30-year mortgage rates. When the Fed raises or lowers the federal funds rate, it primarily affects shorter-term interest rates—like those on credit cards, car loans, and home equity lines of credit.

Yet, there’s a knock-on effect:

- Lowering the federal funds rate tends to put more money into the economy, raising concerns about inflation.

- Mortgage-backed securities become less attractive to investors when inflation is on the rise, which pushes mortgage rates higher.

That’s one reason we’ve seen 30-year mortgage rates increase by about 1% since the Fed started lowering its funds rate in September 2024. Going forward, if inflation subsides or unemployment rises, we may see 30-year mortgage rates come down.

What About Tariffs?

Talks about tariffs—whether on goods from Canada, Mexico, China, or elsewhere—can also affect interest rates in a roundabout way. Recently, mortgage rates improved slightly during some major tariff announcements because investors anticipated the economy might slow down, which can help bring rates down. However, these effects can be short-lived or mixed, so keep an eye on economic news for the latest shifts.

Redding and Shasta County Home Values

According to the Federal Housing Finance Agency (FHFA), which tracks home values across the U.S., Redding saw a 1.22% market appreciation in the third quarter of 2024. Historically, the third quarter (July–September) is one of the busiest times for real estate, so a bit over 1% appreciation is a healthy showing.

- Year-Over-Year Trend: We’ve seen about 2–3% appreciation in recent years, far more modest than the skyrocketing increases of 2021 and 2022.

- Historical Average: Going all the way back to the 1970s, local home appreciation hovers around 5% annually. So, our current 2–3% range is somewhat slower, but still solid.

Supply and Demand

Inventory in Redding is currently around 209 homes on the market—a relatively low level. Depending on the property, it can take about 2–3 months from listing to sale. Demand is strong, thanks in part to a steady flow of buyers from the Bay Area and potential newcomers from Southern California. That demand, paired with modest inventory, suggests home values may hold steady or see slight increases throughout 2025.

Thinking About Buying This Spring?

Spring typically brings more listings, so buyers may have a better selection in the coming months. For those wanting to lock in a stable housing payment, purchasing now can be an excellent strategy—especially if you plan to refinance later if (and when) interest rates dip.

Featured Home of the Month

Address: 3525 Paul Drive, Anderson

Specs: 3 bedrooms • 2 baths • ~1,100 sq. ft.

List Price: Around $250,000

Payment Details: Click here

If you’re a first-time homebuyer, this might be a gem. It’s a clean, comfortable starter home in a convenient location. Here are a few ways you could finance it:

-

100% Financing

- Offer: $265,000 (over asking)

- Ask the seller for a $15,000 credit to cover closing costs

- Approx. monthly payment (including taxes & insurance): $2,136

- Out of Pocket: $0

-

Small Down Payment

- Offer: $260,000

- Ask for a $10,000 credit to help cover closing costs

- Approx. monthly payment: $2,200

- Out of Pocket: $8,500

-

Larger Down Payment

- Offer: $260,000

- Ask for a $10,000 credit

- Approx. monthly payment: $1,904

- Out of Pocket: $25,000

(Note: These figures are for illustration purposes; actual rates and costs will vary based on your credit, loan type, and lender guidelines.)

Why consider this home?

- Affordability: Staying near the $250K price point is great for first-time buyers.

- Equity Building: Even a modest annual appreciation can significantly add to your equity over time.

- Stability: Locking in a mortgage payment means your housing costs won’t rise the way rent does.

With interest rates inching upward and the economy in flux, staying informed is key. Yet, if you’re looking to buy in Redding or Shasta County, the fundamentals remain strong—demand is steady, and inventory is modest. Whether you’re a first-time homebuyer or a seasoned homeowner looking to tap your equity, having the right mortgage strategy can make all the difference.

If you have questions or want to explore financing options, feel free to reach out. I’m here to help you navigate the market and find a plan that works for your unique situation. Here’s to a successful 2025, and I look forward to bringing you more updates in the months to come.

Thanks for reading and see you in next month’s update!